Should I Exercise My Edtech Stock Options?

And more on our upcoming edtech UX webinar, an interview with Ethan and Lilach Mollick, and top edtech headlines!

🚨 Follow us on LinkedIn to be the first to know about new events and content! 🚨

Should I Exercise My Edtech Stock Options?

By Ben Kornell

Summer in the edtech space is usually a season that involves lots of job-switching and new opportunities – a new school year can mean new sales leads, new customer success roles, and new product roadmaps. This summer is a bit different. Layoffs have ripped through the edtech industry in successive waves, which makes job-switching in the current climate entail a series of careful considerations.

That said, a number of us in edtech are still changing jobs and making money moves, and with it comes the age-old question: as an employee, should I exercise my shares? Let’s dive in.

Analyzing Your Stock Options

First off, let’s just admit that when to exercise your options is a deeply personal decision. But alongside the necessary step of consulting with your financial advisor (we at Edtech Insiders are NOT financial advisors), here are a few more points to keep in mind as you make the call:

Down Valuations

The edtech sector is significantly down from our halcyon days of 2020 - 2021; in our opinion, the world simply doesn’t know how to value a post-pandemic, early-AI edtech sector and many are erring on the side of caution. Publicly traded edtech companies (see 2U) and private companies (see BYJU’s) alike have been showing very public signs of major struggle, and there are macro impacts caused by higher interest rates, slowed education sector spending, higher ed enrollment issues, reduced federal spending on K-12 and a broader focus across tech on profits over growth. If your company raised money at edtech’s peak, expect valuations to be 50% or even lower than they were previously, even if your company is on the same growth path.

Strike Price

The value of any shares is relative to the ‘strike price’, the price at which each individual retains the right to buy stock. Your particular strike price is determined by when you joined the company; if you’re a founder, your strike price per share is likely pennies. If you joined later, your strike price will be correlated with the most recent fundraising round- so take a close look at how those rounds have played out. The general rule of thumb is that if there have been two subsequent rounds of “up” funding, your strike price is good.

Preference Stack

Whenever a company is sold, the proceeds are distributed in what is known as a “waterfall”. Lenders get paid first, and then “preferred” investors line up in order, based on whoever has the most “preference.” Of course, “common” shares (where employee options sit) are usually last in this waterfall flow, and employees may sometimes receive nothing at all. As an employee at the bottom of the waterfall, you should look at how much your company has raised (and will raise) and what an exit would have to be in order for the cash waterfall to reach you.

Remember that even if there is an “in the money” (positive) acquisition where the sale price is greater than the amount raised, such acquisitions are often made from a mix of cash and stock, which can limit liquidity (AKA the cash pay-out to equity holders).

Longer Timelines

Edtech exits generally take 5-7 years, but they could be much longer now that market conditions are so hard and wintery. Unlike the 2020-2021 heyday where Edtech IPOs were popping like popcorn, acquisitions are now the most likely exit for any edtech player, and that can be highly dependent on your company’s position in the space and who the other players are. With this in mind, when exercising options, you should consider whether your money could work harder elsewhere (like a market index, paying off debt, etc.) and also what kind of flexibility those other financial vehicles offer in terms of taking your money out.

Full Exercise vs. Partial Exercise

Looking at these factors analytically may lead some to conclude that they shouldn’t exercise their options. But we are human beings, after all - and we get emotionally attached to our equity. For many of us who have poured our blood, sweat, and tears into a company, it can feel very wrong to just walk away. Instead of an all or nothing approach, consider a partial exercise, where you commit a smaller amount (like $5k –$10k) on the chance of a major upside, even if it's unlikely. I call this “stupidity insurance”, and it can often help us make peace with the fact that equity was just one portion of our compensation package.

Considerations for Founders and CEOs

While the current market is difficult for employees joining and leaving companies, rest assured that founders and CEOs (and investors!) feel the pain of this crunch too! Founder and CEO compensation is largely dependent on the value of equity, and retaining and recruiting talent is much harder when equity is underwater.

Here are a few thoughts for founders and CEOs looking for remedies in the current landscape:

Raise a Down Round

While down rounds are painful, bringing in new capital gives a company runway and also sets realistic pricing for new stock grants and options. Use a down round to reset the cap table and refresh the Employee Stock Option Pool (ESOP). The lead investor in a down round should be very motivated to reignite the company’s growth and the upside for employees.

Create New Option Pools

With the support of investors, CEOs can often create new pools of equity tied to major milestones or outcomes. Often called “LTIPs” (Long-Term Incentive Plans), these pools can have a different vesting schedule, strike price, and exercise window than previous pools. Given the current economic climate, investors seem more open to these incentives than before.

Executive Incentives

On top of the existing Employee Stock Option Program, CEOs can sometimes put in place a Management Incentive Plan (MIP). This is generally tied to an exit, where a certain percentage of proceeds (usually between 2-10%) are reserved for management. This helps retain valuable talent ahead of an exit in the next 12-18 months. It’s incredibly important to get investor sign-off on this well in advance, because it can become a point of contention in the middle of an M&A process.

Takeaways

For employees, founders and CEOs (and again, investors!) alike, this edtech winter has been a challenge to navigate. For option-holders, it means that its worth a careful and hard-eyed look, and frankly, for many, now may not be a great time to exercise. For founders and CEOs, it’s important to use this market correction to right-size equity expectations for the long haul.

No matter who you are, though, the key is to stay strong and keep building! Spring is coming…

Announcement: Edtech and AI Book Club

Edtech Insiders is working with our friends at FOHE (Future of Higher Education) to launch an Edtech and AI Book club, bringing together this amazing community to make sense of these wild times.

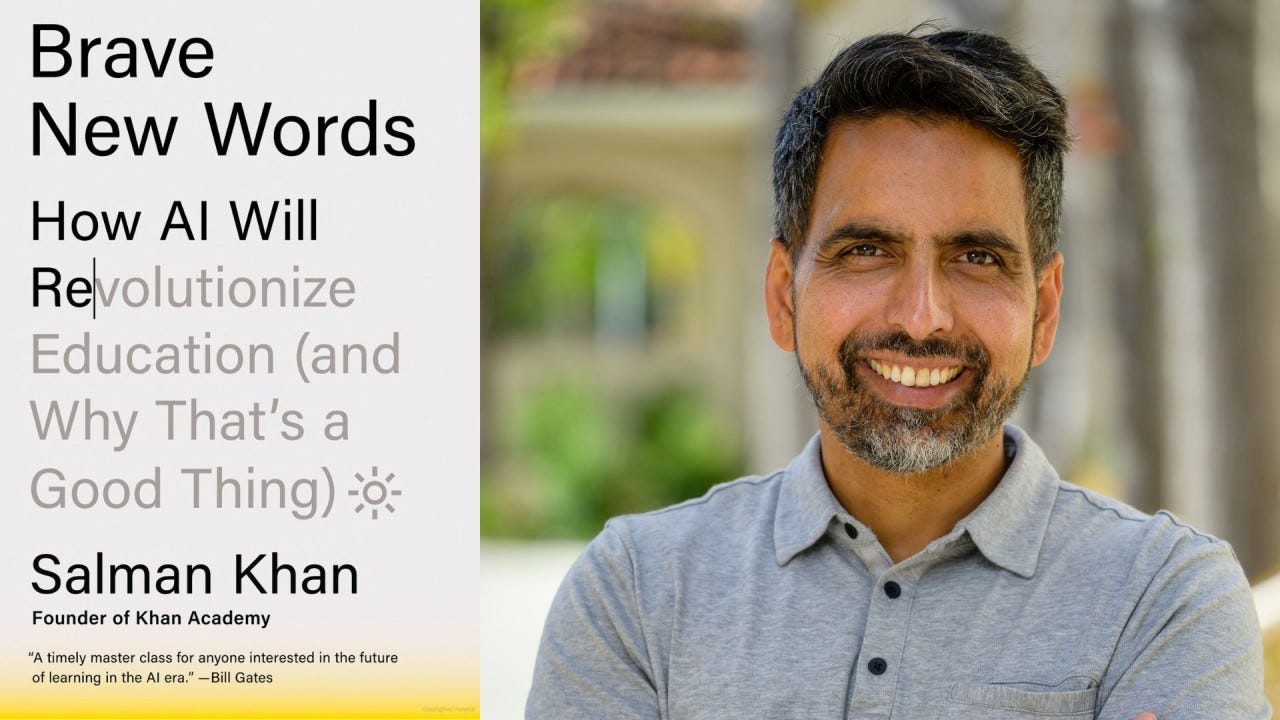

Our first selection will be Sal Khan’s new book Brave New Words: How AI Will Revolutionize Education (and Why That’s a Good Thing). We will be meeting in mid August to discuss with an all-star group of Edtech and AI industry folks.

To prepare, read the book (or at least have AI read and summarize it for you…).

For bonus points, check out Edtech Insiders’ interviews with Sal Khan, Khan Academy CLO Kristen DiCerbo and Sam Altman to learn more about the inside scoop on Khanmigo and the Khan/OpenAI partnership.

Watch this space for more details!

Join Edtech Insiders+

If you love Edtech Insiders and want to continue to support our work, consider becoming a paid subscriber! By joining Edtech Insiders+ you recieve:

Early access to all Edtech Insiders events. No more sprinting to sign up for our monthly happy hours, edtech summits, and online conferences.

Access to our exclusive WhatsApp channel to connect with the Edtech Insiders community and discuss the latest trends and news in our space.

Access to exclusive member content, including interviews, panels, videos and articles.

All proceeds from subscriptions will help us invest in our podcast, newsletter, events, and community. Our goal is to make Edtech Insiders an enduring and sustainable community offering that connects the edtech ecosystem!

We would be so excited if you decide to join us as a member of Edtech Insiders+.

Edtech Insiders Events

Webinar: Solving EdTech Problems with a UX Mindset

Join us for the first part of our UX in EdTech webinar series! In this session, Nicole Gallardo, Founder and Chief Design Officer at Founders Who UX, will share her insights on enhancing your learning products and user experiences.

Date: August 1, 2024

Time: 1-2pm ET / 10-11am PT

In this webinar, you will learn:

5 key UX strategies for improving EdTech products

Techniques to make premium UX accessible for your projects

Methods to create user-centric learning experiences

Top Edtech Headlines

1. U.S. ED Issues Guidance for AI Edtech Developers

The U.S. Department of Education has released new guidance for AI Ed-Tech developers, emphasizing the need for human oversight in AI-driven educational tools. The guidelines recommend that AI tools be designed based on evidence-based practices, ensuring they do not amplify biases or infringe on students' civil rights. The document aims to foster responsible AI development in education by balancing innovation with ethical considerations and data privacy.

2. What Aspects of Teaching Should Remain Human?

As AI becomes more integrated into education, there's an ongoing debate about which aspects of teaching should remain distinctly human. A new article by The Hechinger Report highlights the use of AI tools to assist teachers, improving efficiency and engagement in the classroom, while emphasizing the irreplaceable value of human interaction in motivating and understanding students.

3. Learning from Los Angeles Unified School District's "Ed"

A new article by Education Week responds to Los Angeles Unified School District's AI chatbot, "Ed," providing five key strategies for other districts to avoid similar pitfalls when integrating AI into educational systems.

4. Salesforce Releases New AI Tools for Higher Education

CRM powerhouse Salesforce is quietly doubling down on education-specific AI tools for higher education institutions. According to Edtech magazine, tools will include:

Einstein Copilot, an AI chatbot tailored to admissions and recruitment offices that can answer student questions at all hours

A degree-planning tool to help students and advisers plan from enrollment to graduation and measure progress in real time

A skills generator that will give AI recommendations to faculty and staff to identify “market-relevant skills” students will need to enter the workforce

Mentorship summaries that will help match students and alumni with potential mentors

EI Interview: Ethan and Lilach Mollick

We have had some amazing guests on The Edtech Insiders Podcast in the last few weeks. One of our stand-out interviews from this past week was with Lilach and Ethan Mollick, Co-Directors of the Generative AI Lab at Wharton!

Here’s a deep dive on our interview with Lilach and Ethan, and we encourage you to give the full episode a listen for more!

The Potential of AI in Education

Ethan and Lilach Mollick discussed the immense potential AI holds for addressing long-standing challenges in education, such as adaptation, customization, and extending classroom capabilities.

"There is just a lot of potential here to do things right... The creator is often quite different, distant from the classroom. And so then we have a tool that does a whole bunch of things that were really hard problems... The potential here is so huge. And what you could accomplish right away is so dramatic."

- Ethan Mollick

Games and Simulations in Education

Lilach Mollick shared insights from her research at Wharton, where she used games and simulations to teach practical skills. The arrival of AI, like ChatGPT, has significantly simplified and accelerated this process.

"We've done this... with a resource-heavy set of developers and instructional designers... When ChatGPT came out, we saw that 60-65% of what we were doing could really be done with a single prompt because of the AI's improvisational, and sort of cold reading capacity."

- Lilach Mollick

AI's Impact on Classroom Dynamics

Ethan discussed how surprisingly effective AI has been in classrooms, enhancing pedagogical processes, encouraging reflection, and improving the quality of student work.

"I've read thousands and thousands of essays over the years, right? And suddenly, there's this performance improvement, not just there, but also ideation, people are coming with better ideas for projects... the thinking is becoming more interesting." - Ethan Mollick

The Concept of Co-Intelligence

The concept of co-intelligence, as discussed in their book, envisions a symbiotic relationship between humans and AI, enhancing rather than replacing human capabilities.

"We do get to decide where to draw the line about what should be done by AI or what by people, and especially classrooms where we get to decide... these are old techniques that we've developed a long time ago, they still have value."

- Ethan Mollick

The Role of AI in Enhancing Learner Agency

Together we discussed how AI can empower learners by allowing them to co-construct their learning experiences, and the role educators play in adapting AI tools to their unique contexts.

“You can prompt the AI to act more like... a good teacher, including one that knows where students usually fail on this particular topic, what are some sticking points... this is the kind of thing where educators are really empowered to build something with words." - Lilach Mollick

Curious to Learn More?

You can listen to our full interview with Ethan and Lilach Mollick, as well as interviews with many other edtech founders, investors, and thought leaders at The Edtech Insiders Podcast! Check it out, and as always, we’d love to hear what you think!

This edition of the Edtech Insiders Newsletter is sponsored by Tuck Advisors.

Since 2017, Tuck Advisors has been a trusted name in Education M&A. Founded by serial entrepreneurs with over 25 years of experience founding, investing in, and selling companies, we believe you deserve M&A advisors who work as hard as you do. Are you a founder thinking of selling your company? Have you received any UFO’s (unsolicited flattering offers) and need help determining if they’re real or hoaxes? We can help! Reach out to us at confidential@tuckadvisors.com.

Funding, Mergers, and Acquisitions

Funding

Speak raises $20M / US, Language Learning / Buckley Startup Fund, OpenAI Startup Fund, Khosla Ventures

Pok Pok raises $6M / US, Content Provider / Adjacent, Konvoy Ventures, MetaLab Ventures, Banana Capital

MEandMine raises $4.5M / US, Mental Health / K5 Global

Taskbase raises €3.6M / Switzerland, Content Platform / Mediahuis Ventures, Acrobator Ventures, Bloomhaus Ventures AG

Neople raises €1.5M / Netherlands, Talent Platform / Peak Capital, Curiosity

Keenious raises €1.3M / Norway, Academic Integrity / Spintop Ventures, Investinor

Brookfield Asset Management-led consortium invests in GEMS / Dubai, K12 School Provider

Weatherford Capital invests in BusPatrol / US, School Infrastructure

Acquisitions

Pathify acquires Navengage / US, Extracurricular Activities